Abstract

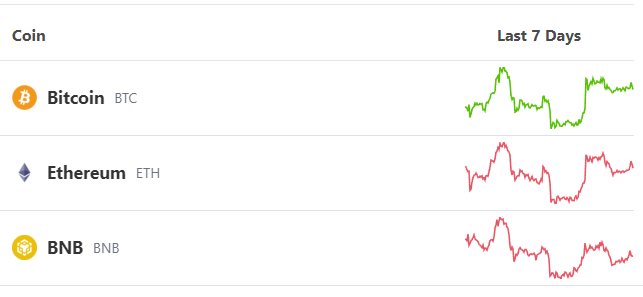

One of the issues facing the Radiant protocol in the early days has been the need for a deep on-chain liquidity pool for the RDNT token, with current total liquidity on-chain currently at ~$1M. While the liquidity pool is sufficient for small buys and sells, it is prohibitive for larger buyers and sellers. For example, a $25K buy of RDNT leads to a 4% price impact, which is not conducive to attracting funds and larger buyers and sellers.

While the initial approach was to attract external LP through heavily incentivized emissions, that proved to be an inefficient method, as the incentivized emissions in RDNT only led to a marginal increase in LP liquidity. The feedback that the community gave on this could be summarized as follows:

- It did not make sense to LP when the single-sided RDNT token locking provided a compelling value in terms of protocol fees

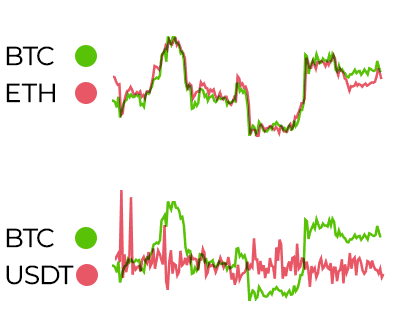

- The 50-50 pool has too much impermanent loss given the volatility of the RDNT token, and thus is not attractive to potential outside LPs

- Using a WETH pair prevents LPs from taking advantage of the staked ETH yield, which has shown to be very compelling

While working on Radiant V2 architecture, critical community feedback discussed ways to improve liquidity, reduce slippage, and create a fairer exchange for users who provide value to the protocol.

Motivation

Improving on-chain liquidity would provide a more seamless experience for Radiant Protocol users as well as new entrants to Radiant across Arbitrum, BNB, and future chain deployments.

Specifications

- Shifting the current 50-50 Arbitrum RDNT-WETH pool (0.3% fee) on SushiSwap to an 80-20 RDNT-wstETH pool on Balancer Protocol (0.5% fee)

- This proposal will lead to meaningfully less IL than on a 50-50 pool, and the “ask” of LPs in terms of putting up ETH is meaningfully less than the 50-50 pool

- While the price impact on 80-20 pools is greater than 50-50, the additional capital this will attract will more than offset the price impact changes and on a net basis, will improve liquidity and reduce slippage overall on-chain

- Using an LSD (liquid staking derivative) on Balancer would make this eligible for one of Balancer’s core pools, which means that Balancer’s portion of the protocol fees (50%) would be refunded in the form of bribes to the LP pool

- A slightly higher trading fee is also a disincentive mechanism for instantly dumping RDNT earned through emissions and is more in line with the volatility profile of the RDNT token

- Changing the WETH pair to wstETH (wrapped staked ETH through Lido) allows LPs also to take advantage of staked ETH yield on top of the fees they are earning as an LP, removing the opportunity cost of becoming an LP with WETH

- There isn’t an adequate Balancer-equivalent on BNB Chain, so that LP pool will need to be 50-50 RDNT-WBNB, or potentially a staked wBNB derivative

- Radiant V2 Functionality - Requiring Locked LP tokens instead of single-sided RDNT to earn protocol fees on all chains

- Solely locking RDNT tokens does not improve liquidity of the protocol; rather it serves to delay tokens coming into the market. By requiring locking LP tokens instead of single sided RDNT, the liquidity profile will meaningfully improve for the RDNT token

- The exchange of value here has been imbalanced, as it makes sense for those with “skin in the game” to be the ones that are the beneficiaries of protocol fees. These are the users that provide liquidity and enable the protocol to operate more seamlessly

- This would apply to Arbitrum when re-launched with v2 functionality, BNB, and any additional chains the Radiant protocol deploys to

- With LP tokens capturing all of the protocol fees, the feedback would be to eliminate Pool2 emissions entirely, as a way to further reduce RDNT inflation (LP staking emissions have already been reduced 85%)

Steps to Implement

- Upon launch of v2, move current Arbitrum 50-50 RDNT-WETH Sushi pool (0.3% fee) to an 80-20 RDNT-wstETH Balancer pool (0.5% fee)

- Shift protocol fees from single sided staking RDNT lockers to locked LP tokens (Balancer Pool Tokens for Arbitrum, PCS for BNB, etc.) to earn protocol fees

- Reduce “Pool2” emissions to 0

Timeline

These changes would be put into effect upon the v2 launch of the protocol. Would do so gradually so there would be some overlap of 50/50 and 80/20 pools, but locking LP tokens would be implemented at launch of v2

Overall Cost

Minimal. This would be a shift of existing liquidity.