Abstract

DeFi 1.0 has been plagued by copycat protocols with little utility and farm tokens that have used for short-term incentives, but are forgotten about quickly. Existing emissions models have failed at holding value over time. See the below chart, which tracks “DPI,” the “DeFi pulse index” of DeFi 1.0 tokens against ETH over time. Most of these protocols have gotten farmed into the ground.

This occurred for several reasons:

- The tokens did not provide sufficient utility, and “governance-only” tokens got appropriately priced over time relative to the value of governance for that protocol

- Extremely low barrier to earning DeFi tokens for mercenary liquidity providers. LPs could deposit tokens, earn yield, sell off tokens, then move on once yields compressed. This was seen time and time again on >95% of DeFi protocols.

Since our launch months ago, Radiant Capital contributors have spent significant time in discussions with community members and advisors about how to address these problems via our next iteration - Radiant V2.

Radiant V2:

Radiant V2 includes revolutionary changes to core protocol mechanics, emissions, utility, and further cross-chain functionality. A summary of some feedback discussion is available on the Radiant DAO forum, Discourse: RFP 3: Improve RDNT On-Chain Liquidity for v2 - Fund Allocation - #3 by arosenthal4

Here is a summary of takeaways from conversations with community members and advisors:

-

Initial emissions were unsustainable and led to too much inflation. While this sparked an early surge in the total value of deposits (peaking at around $500M), mercenary liquidity was not “sticky” and did not further the protocol’s capabilities. This emissions model prompted band-aid solutions such as RFP-2 in order to reduce emissions.

-

Insufficient runway. In relation to above, given that in the original plan, lender/borrower emissions would run out after 24 months, which is not sufficient to achieve long-term cross-chain vision

-

Low incentive to provide liquidity to the protocol. Single-sided staking gave users utility in the form of protocol fees, even with reward tokens being distributed at high rates for RDNT LPs

-

Exit penalties were not optimally designed. A user who exits on the final day of a vest shouldn’t be penalized in the same way as someone who exits within the first minute of a vest. This system forces a user into a suboptimal binary decision (exit or fully vest). Consequently, this led to a high exit rate in early days and further highlighted the need for inert liquidity.

-

Fixed unlock periods create unnecessary FUD. Grouping unlock events into universal weekly epochs creates weird game theory dynamics which aren’t particularly helpful or useful.

-

Mercenary capital is incentivized. This is not exclusive to Radiant, but there is a general trend in decentralized finance toward mercenary capital—investors who extract as much value from the protocol as possible and move on when yields are compressed. For example, the optimal game theory strategy for many DeFi funds would be to leverage their assets fully and take advantage of incentivized emissions periods—but not perform actions that improve the protocol (such as providing accessible liquidity).

-

Incentives need to favor long-term support. Lock periods of 28 days (or less) do not incentivize that type of behavior. Furthermore, there is little impetus to withdraw and re-lock, given expired locks still earn emissions.

-

Proposed shift from Single-Sided Locks to LP Locks Present additional IL risks: Good discussion around this here but given concerns about IL, there is a push from users provide additional utility to LP lockers

Discussions with community members and advisors centered around a similar idea:

How does a future version of Radiant create a better utility exchange between lenders/ borrowers and the protocol?

What should users have to do to earn emissions?

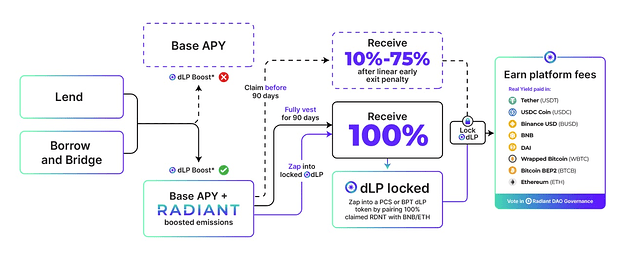

Part 1: “Dynamic Liquidity” - Rewarding Long-Term Investors

A proposed idea by a community member has gotten a lot of traction internally called “Dynamic Liquidity Provisioning.” This proposal would mean that only a subset of users would be “eligible” for emissions at any given time based on the value they provide to the protocol.

This will be part 1 in a series of posts here in Discourse from our community outlining various strategies to solve some of Radiant’s initial constraints whilst ushering in a new ecosystem

An ecosystem focused on:

- Sustainable "real yields”

- Legitimate value accrual leading to positive PNLs for the DAO (Profit & Loss statements)

- Higher barrier to entry to earn emissions

- Use cases with real utility for the future and longevity of DeFi (seamless cross-chain borrowing, within minutes).

So: how does dynamic liquidity solve some of DeFi 1.0’s pain points?

TLDR:

-

Users that provide value to protocol unlock the ability to earn incentivized (RDNT) emissions.

-

Users that simply deposit but don’t add value to protocol = earn natural market rates but don’t earn RDNT emissions. Users can still borrow cross-chain seamlessly, within minutes - but will no longer earn RDNT emissions (only market rates).

Users would need to provide a certain % of locked LP tokens (in USD terms) relative to the size of their deposits on the protocol. Let’s use an example and say that the threshold to earn emissions is 5% of total value of deposits.

User 1: Lends 1M USDC on Radiant and has $0 of LP tokens locked. The user would earn a base deposit APY but would NOT earn incentivized emissions

User 2: Lends 1M USDC on Radiant and has $50,000 of RDNT/BNB dLP locked. This user would be eligible for RDNT emissions (assuming a minimum 5% threshold is met)

The first discussion around shifting from a single-sided lock to an LP lock (https://community.radiant.capital/t/improve-rdnt-on-chain-liquidity-for-v2/174?n=167060963036) will have the impact of improving on-chain liquidity across-chains. The hope is that this will be an additional incentive, given some of the fair points mentioned from community members regarding IL risk

This dichotomy fosters a healthy flywheel of value capture & new game mechanics

Farmers will be attracted to the higher yields since not many participants will initially qualify for the dLP-boosted emissions threshold, which could drive demand for dLP.

As demand for dLP increases, the market cap rises, and thus emissions for eligible RDNT yield farmers will rise, driving additional demand to meet the dLP requirement.

A fun potential game mechanic can emerge where selling pressure is met by natural buyers who wish to remain eligible for RDNT emissions by defending their 5% eligibility threshold.

In this model, an ecosystem emerges where distributions (company expenses) only grow as “value to protocol” (liquidity, borrowing & buying) grows.

Here is how the proposed mechanism would function:

What is the net effect of this?

When we looked at the existing lenders/borrowers on v1 of RDNT, most of the largest lenders and borrowers had 0 RDNT locked. In v2, with Dynamic Liquidity implemented, most of the TVL would be “ineligible” for reward emissions.

This would mean that eligible users would receive meaningfully higher emissions, assuming the same number of RDNT emitted per second. So there becomes an interesting feedback loop that can be constructive in helping attract long-term liquidity and those thinking long-term in the protocol.

What happens if your LP tokens reduce in value or deposits increase in value, thus taking a user from “eligible” to “ineligible”?

This is part of the equation that a user needs to consider, with how close to the threshold they will be relative to the total value of their deposits. If the LP value / total value deposited falls below the threshold, then emissions will stop to that user and redistribute to all eligible users. This re-allocation would happen dynamically

Won’t TVL decrease a lot?

Mercenary TVL adds little value to the protocol but does not promote long-termism and capital is fleeting. The capital that the protocol would be best suited to attract, would be capital that has more long-term and not “incentive mine” mentality.

If a user wishes to deposit collateral with zero exposure to RDNT, they can still do so and earn market rates (paid in the deposited asset). If this same user wishes to borrow USDT to ape into a NFT project on AVAX, they can still do so (while paying market borrow rates)

The protocol is better suited for long-term liquidity providers and those looking to add value to the protocol. Also, if TVL leaves, the APR for the remaining eligible lenders and borrowers will proportionally increase. This will then have the net effect of once again attracting new lenders/borrowers, but this time ones who are comfortable with adding liquidity to the protocol through adding Liquidity on the respective chain.

In discussions with community members and advisors, there’s been a very bullish sentiment on Dynamic Liquidity

We’d love for the Radiant DAO community to further battle test the assumptions made above.

We look forward to reading your comments & suggestions.