Survey-106

Community Roadmap 1.0 — Prioritizing the Feature List

![]() VOTE FOR YOUR FAVORITE FEATURES TO HELP SHAPE THE RADIANT COMMUNITY ROADMAP 1.0 FOR 2026

VOTE FOR YOUR FAVORITE FEATURES TO HELP SHAPE THE RADIANT COMMUNITY ROADMAP 1.0 FOR 2026

Community Roadmap 1.0 Survey

This survey, while comprehensive and inclusive in scope, also seeks to trim features that are deemed unnecessary by the community by asking the participants to only select roughly 33% of the available proposed features to help generate separations between the features’ overall scores that will inform the team how to trim the list’s bottom portion before the on-chain voting of the finalized and prioritized Radiant Community Roadmap v1.0.

The survey’s results will be tallied, reconciled, and entered into the Community Roadmap list in the “Community Vote” column, to be calculated into the “Overall Score” formula, which officially prioritizes every proposed feature. The top 10% of the finalized list is likely to be implemented in 2026, while the bottom 90% will not. The actual cutoff point is dependent on market dynamics and level of resources (funding, team size, time…), and can change.

To work within Discourse’s 20 options per survey limit, this longer feature list was split into 2 surveys: one for the proposed retail features and the other for the proposed institutional and platform features. PLEASE VOTE ON BOTH SURVEYS.

Survey 1 (Institutional & Infrastructure Features)

Select (not weighted) up to 4 of the 12 proposed features (see the expanded feature list here for additional information , or look up the condensed feature list in Appendix A below) that you would like to be considered and prioritized on the Radiant Community Roadmap v1.0. Your choices will be aggregated and reconciled with other voters to eliminate the bottom portion and prioritize the rest for the community to ratify on-chain (snapshot).

- RAD-1 – Radiant Labs In-house Risk / Parameter Engine

- RAD-2 – Rebrand / Rebuild Radiant UI Front-end

- RAD-3 – Radiant Labs (Param / Research / Credit)

- RAD-4 – Radiant Liquidator Bot

- IN-1 – Institutional Custody Integration

- IN-2 – Dark / Private Lending Pools

- IN-3 – Permissionless / Semi-permissioned RIZ Markets

- IN-4 – Private Lending Markets, Lending Markets as a Service

- IN-5 – New Institutional Dashboard & API Access

- IN-6 – LP Insurance Integration

- IN-7 – Radiant Securechain

- RE&IN-1 – Bond Market

Survey 2 (Retail User Features)

Select (not weighted) up to 6 of the 20 proposed features (RE-4 - Shielded Voting was eliminated due to Discourse 20 cap. See the expanded feature list here for additional information , or look up the condensed feature list in Appendix A below) that you would like to be considered and prioritized on the Radiant Community Roadmap v1.0. Your choices will be aggregated and reconciled with other voters to eliminate the bottom portion and prioritize the rest for the community to ratify on-chain (snapshot).

- RE-1 – Under-collateralized Lending via Credit Scoring in Isolated Markets

- RE-2 – 1-Click Longing / Shorting via RIZ

- RE-3 – Real World Asset (RWA) Markets

- RE-5 – Bribing & Gauge System via dLP Locking

- RE-6 – Collateral & Debt Swaps

- RE-7 – New Stablecoin RIZ Markets

- RE-8 – Add More Languages to UI + Discord

- RE-9 – Radiant Dune Dashboards

- RE-10 – Telegram / Discord Bot for Position Monitoring

- RE-11 – Rebuild / Renew RIZ Vaults

- RE-12 – Focus on LP Tokens as Collateral

- RE-13 – Governance Delegation

- RE-14 – New EVM Chain Expansion

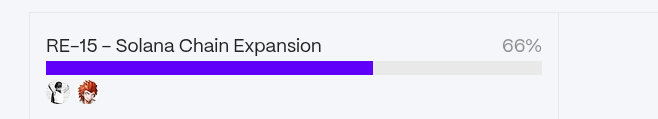

- RE-15 – Solana Chain Expansion

- RE-16 – Omnichain User Abstraction

- RE-17 – Radiant AI Agent

- RE-18 – Credit / Debit Card Top-Up Support

- RE-19 – Create Sections / Categories within Our Markets

- RE-20 – Focus on Equity Tokens

- RE-21 – Web3 Abstract Savings Account

Appendix A: Condense Proposed Feature List

| ID | Feature | Short Description | Investor Class |

|---|---|---|---|

| RAD-1 | Radiant Labs In-house Risk/Parameter Engine | Internal research hub for protocol risk settings, wallet-specific tuning, and capital efficiency modeling. | - |

| RAD-2 | Rebrand/Rebuild Radiant UI Front-end | Modernize the platform UI/UX for accessibility, appeal, and retention. | - |

| RAD-3 | Radiant Labs (Param/Research/Credit) | In-house team for economic research, risk tools, and capital efficiency tuning. | - |

| RAD-4 | Radiant Liquidator Bot | An automated tool designed to monitor and execute liquidations on the Radiant protocol, helping maintain system stability by closing undercollateralized positions. | - |

| IN-1 | Institutional Custody Integration | Provide support for Fireblocks/Copper/BITGO-like services for institutional security and capital onboarding. | Institutions |

| IN-2 | Dark / Private Lending Pools | Lending pools with higher trust assumptions or limited access to enable institutional-grade risk settings. | Institutions |

| IN-3 | Permissionless/Semi-permissioned RIZ Markets | Users or DAOs can create new isolated lending markets, broadening asset support. | Institutions |

| IN-4 | Private Lending Markets, Lending markets as a service | Offer isolated or white-label lending pools for DAOs, family offices, and institutional investors. | Institutions |

| IN-5 | New Institutional Dashboard & API Access | Professional-grade interface for fund managers and power users managing large positions. | Institutions |

| IN-6 | LP Insurance Integration | Integrate with DeFi insurance providers to cover lending market risks, liquidations, or RIZ vault exposures. | Institutions |

| IN-7 | Radiant Securechain | A KYC-enabled Layer 2 network, freezable and secured by staking RDNT. RDNT also serves as the GAS token for all transactions. | Institutions |

| RE-1 | Under-collateralized Lending via Credit Scoring in Isolated Markets | Enable loans with lower collateralization using wallet credit scoring for improved capital efficiency and access. | Retail |

| RE-1 | 1-Click Longing/Shorting via RIZ | Enable efficient on-platform leveraged trading through simplified UI and vault integrations. | Retail |

| RE-3 | Real World Asset (RWA) Markets | Launch isolated lending markets for tokenized T-Bills, real estate, or invoices to bridge TradFi capital. | Retail |

| RE-5 | Bribing & Gauge System via dLP Locking | Direct emissions using gauge weights influenced by bribes, aligning incentives. | Retail |

| RE-6 | Collateral & Debt Swaps | Let users swap between collaterals and/or debt positions to manage risk and optimize yield. | Retail |

| RE-7 | New Stablecoin RIZ Markets | Support EUR, GOLD, and BOND stablecoins to broaden collateral types. | Retail |

| RE-8 | Add More Languages to UI + Discord | Multilingual access for international user growth and support. Especially, Chinese, Korean, and Japanese. | Retail |

| RE-9 | Radiant Dune Dashboards | Public analytics for market health, liquidation risk, and emissions; improves transparency and trust. | Retail |

| RE-10 | Telegram/Discord Bot for Position Monitoring | Bots notify users of liquidation risks and account status in real time. | Retail |

| RE-11 | Rebuild/Renew RIZ Vaults | Upgrade yield vaults to smart routers optimizing allocations across RIZ markets. | Retail |

| RE-12 | Focus on LP Tokens as Collateral | Enable LP tokens as collateral to unlock deeper yield-generating capital. | Retail |

| RE-13 | Governance Delegation | Allow easy delegation of DAO votes to trusted experts to improve participation and informed decision-making. | Retail |

| RE-14 | New EVM Chain Expansion | Deploy on new EVM L2s or alt L1s to capture additional liquidity and users. | Retail |

| RE-15 | Solana Chain Expansion | Deploy on Solana to capture additional liquidity and users. | Retail |

| RE-16 | Omnichain User Abstraction | A single UI for all chains, where users can deposit on one chain and have that collateral applied across all chains. This way, users can borrow on any other chain. | Retail |

| RE-17 | Radiant AI Agent | Integrate a Radiant agent that helps users automate strategies and monitor positions or simply answer questions. | Retail |

| RE-18 | Credit/Debit Card Top-Up Support | Allow other methods, such as credit/debit cards, to top up EOA wallets through the Radiant UI, possibly autodeposit the funds as well. | Retail |

| RE-19 | Create sections/categories within our markets | Now that the list of assets has grown, organize them into categories to help users filter and find the best options for their needs (e.g., Stablecoins, ETH ecosystem, BTC, DeFi, etc.). | Retail |

| RE-20 | Focus on Equity Tokens | Tokens that represent ownership shares in companies, enabling fractional ownership and easier transferability on blockchain networks. | Retail |

| RE-21 | Web3 Abstract Savings Account | Radiant Savings Account is a decentralized, smart-contract-powered savings solution, with fully a abstracted interface. | Retail |

| RE&IN-1 | Bond Market | The Radiant Bond Market brings fixed-income investing to DeFi, offering tokenized bonds with predictable yields, and transparent risk profiles, while enabling DAO to raise funds. | Retail & Institutions |

NOTE: Please keep the ideas coming by making the entries into the Radiant Discord’s Feedback channel

Abstract

This marks a historic milestone — positioning Radiant Capital as the first DeFi protocol (and potentially the first in all of crypto) to decentralize its entire roadmap design while maintaining institutional-grade execution standards.

After a long period of ideation with the community, this survey will now facilitate the force ranking effort (resulting bottom portion will be trimmed) of the DRAFT Radiant Community Roadmap feature list, which will then be presented on-chain (snapshot) as the Radiant Community Roadmap v1.0 for ratification. While it is generally safe to assume that the top 10% of the finalized and prioritized feature list will “likely” be implemented in 2026, and the bottom 90% will NOT, the actual cutoff point is dependent on market dynamics and available resources (funding and team size…).

Motivation

Executing on the community-approved remediation plan, and reinforcing security through the Guardian Fund, HyperNative, and multi-layered signers, the protocol is now prepared to evolve from reactive governance to proactive, decentralized product strategy — the hallmark of DeFi 3.0.

-

Why now? Past RFPs (e.g., RFP-48: Community Council Election, RFP-52: Guardian Fund) established the foundation for community-led governance, treasury protection, and institutional-grade operations — paving the way for the DAO to co-create its next phase of growth.

-

Why this matters: Empowering the community to directly shape the roadmap ensures alignment among user priorities, protocol economics, and long-term resilience — reinforcing Radiant’s position as the standard-bearer of DeFi 3.0.

Rationale

-

First in DeFi (and crypto): While DAOs vote on budgets or emissions, no major protocol has fully decentralized the roadmap design process and ownership. Radiant once again leads in innovation, this time with DAO governance.

-

Transparency & empowerment: Every non-administrative roadmap action - from feature requests and removals to prioritization originates from the community.

-

Sustainable governance: This process creates a repeatable model for annual or quarterly roadmap formation, ensuring Radiant remains both competitive and community-aligned.

Timeline

-

Publish Date + 6 Weeks: Publish survey + gather community input for 6 weeks.

-

+ 2 Weeks: Council compiles results → stabilizes list.

-

+ 4 Weeks: Launch Weighted Snapshot vote for 4 weeks.

-

+2 Weeks: Publish Community Roadmap 2026.

Conclusion

This survey inaugurates DeFi’s first fully community-driven roadmap process. By merging open survey feedback, council synthesis, and on-chain weighted voting, Radiant Capital – backed 24/7 DeFi’s first decentralized reserve fund (Radiant Guardian) – reinforces its evolution from an omnichain lending pioneer to the Guardian of DeFi — setting a new gold standard for decentralized, institutional-grade governance and innovation.

Before the Community Roadmap is implemented, the following items are included in the near-term roadmap:

- Guardian Fund Phase 2

- Adding Polygon Chain (USDC, WBTC, WPOL, WETH, wstETH, USDT)

- Adding Optimism Chain

- Adding PAXG and AAVE to mainnet

- Bugfixes and UI changes