Summary

Chaos Labs provides full-cycle risk management solutions for DeFi protocols to protect against market fluctuations, black-swan events, liquidity-based assaults, and market manipulation. Our integrated strategy ensures protocols are fortified against potential risks and unexpected incidents. By continuously monitoring protocol positions and liquidity, we enable regular and prompt risk parameter adjustments to enhance protocol performance under dynamic market conditions.

Chaos Labs is pleased to propose a collaboration with Radiant, intending to establish a robust risk management platform to mitigate against market volatility and economic attacks on protocols and safeguard user funds. Our comprehensive approach will provide coverage across EVM-compatible chains and potentially beyond, subject to the approval of the Radiant community.

As part of this partnership, Chaos Labs will provide customized access to a suite of risk tooling. This will include the following:

- Risk tooling, which comprises custom risk dashboards for monitoring protocol and wallet health

- Protocol risk alerting infrastructure based on key health and usage metrics.

- Customized simulations designed to optimize protocol parameters

About Chaos Labs

Chaos Labs is a leading cloud platform that offers comprehensive risk management solutions and economic security for DeFi protocols. We understand the complexities of decentralized finance and build complex and scalable simulations that can battle test protocols in adversarial and chaotic market conditions. Our cutting-edge risk and security tooling helps protocols better manage risk exposure, protect user funds, and ensure the long-term stability of the DeFi ecosystem.

As part of our commitment to offering top-tier risk management solutions, we collaborate with DeFi protocols to build valuable tooling that creates more efficient and secure marketplaces. We strive to build state-of-the-art solutions customized to meet our client’s unique needs, helping them navigate the ever-evolving landscape of decentralized finance.

Partners that we have worked with include Aave, Osmosis, Benqi, dYdX, Uniswap, Chainlink, and more.

Prior work with Radiant Capital

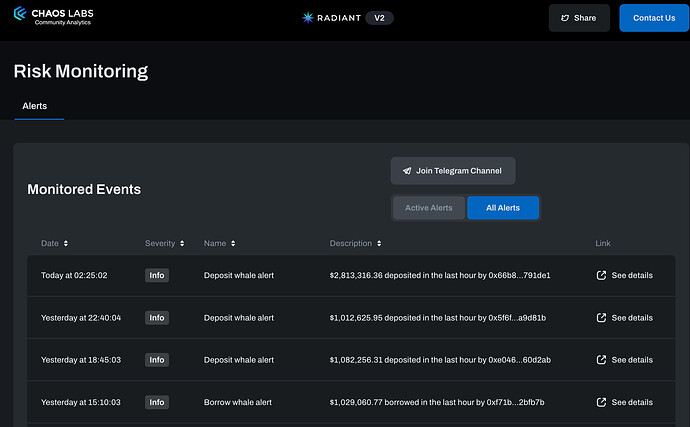

Over the weekend of March 23rd, the Radiant team expressed concern regarding on-chain activity related to the protocol, prompting them to seek potential support and monitoring to mitigate risks. In response, Chaos Labs developed an automated alerting system to monitor for “Whale” positions of over $1 million.

Building upon this successful collaboration, Chaos Labs aims to expand this platform into a comprehensive risk monitoring suite and offer it to the broader Radiant community with the support of this grant. Through this partnership, we aim to fortify the security and stability of the Radiant ecosystem.

The Chaos Labs’ offering

Chaos Labs delivers an all-encompassing market risk management solution comprising software and services. Our platform offers end-to-end management of protocol activity, including risk monitoring, alerting, management, and optimization. Our aim is to provide partner DAO communities with effective market risk management solutions that ensure their long-term viability and growth in dynamic market conditions.

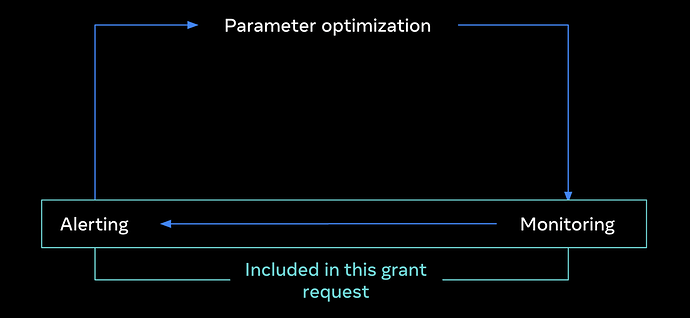

As a part of this grant, we are offering to build monitoring & alerting tooling for the community to understand better and analyze risks and individual wallet positions on the protocol.

We view this as the foundational layer of our offering and intend to expand our product suite in the future, tailoring it to the specific needs of the DAO community.

At a high level, an engagement with Chaos includes:

- Real-time monitoring & observation: Chaos Labs offers a comprehensive solution that enables relevant parties to access critical data for assessing ecosystem risk and protocol health. Our platform features data dashboards, charts, and graphical interfaces that allow users to view important data at the individual asset, market, and wallet levels. Moreover, we utilize a macro lens to evaluate the contribution of each factor to the protocol’s overall health to prevent bad debt and avoid potential losses of user funds. Our goal is to empower users with the insights they need to make informed decisions and effectively manage risks associated with DeFi protocols.

- Real-time data ingestion and risk assessment are essential for comprehensive and effective risk management. By continuously ingesting and analyzing data in real time, Chaos Labs can identify potential risks, exposures, and the surfaces and protocol levers that could impact the system’s stability and performance. This enables us to proactively address and mitigate risk before it becomes a critical issue, ensuring our clients’ assets are protected, and the protocol operates smoothly.

- By employing real-time data ingestion and analysis, Chaos Labs can proactively identify and address potential risks and exposures before they become major issues. This approach ensures that the growth of the protocol is sustainable and well-managed, with risks identified and mitigated in a timely and efficient manner. As a result, the long-term stability and health of the system are safeguarded, and potential losses of user funds are minimized.

- Observability is a critical aspect of managing the health and performance of any complex system, including DeFi protocols like Radiant. It involves continuously collecting and analyzing data from various sources, including accounts, market supplies, secondary market liquidity, logs, metrics, and traces, to measure and understand the protocol’s internal state.

- Monitoring involves observing and tracking various aspects of protocol performance and health indicators over time, while alerts are notifications triggered by pre-defined conditions or events requiring immediate attention. The monitoring system collects real-time data, analyzes it, and generates alerts when specific thresholds are exceeded, or abnormal conditions arise. This enables the team to proactively manage risks and take corrective actions before any adverse impact on the protocol.

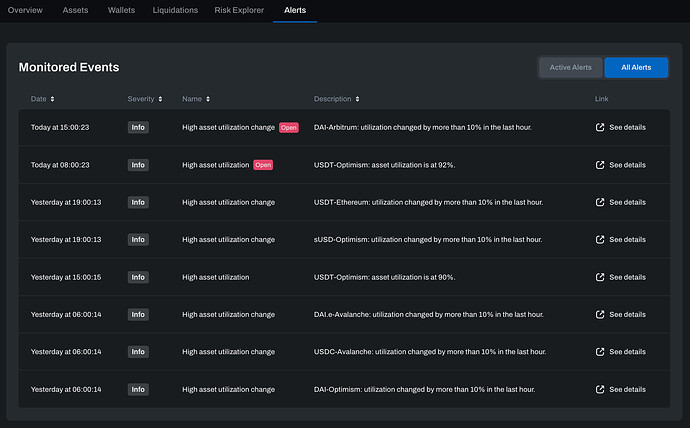

- Alerts & Notifications: Chaos Labs recognizes that the DeFi market continuously evolves and requires robust and adaptable risk management strategies. To address this challenge, we offer a bespoke risk platform that provides users relevant alerts tailored to their on-chain positions. This approach ensures that users are promptly notified of potential risks or market changes that could impact their position. Moreover, it fosters ongoing conversations around protocol parameterization, enabling users to stay informed and engaged in the risk management process. By leveraging these tools, users can effectively manage risks in real-time, minimizing potential losses and optimizing their portfolio performance.

- Alerts are essential in providing immediate notification of potential risks or changes in market conditions that may impact system performance. When coupled with monitoring and observability tools, a comprehensive framework for managing the stability and reliability of complex systems in real time is created. By leveraging this approach, users can detect and mitigate potential risks before they become critical, ensuring the long-term sustainability and health of the system.

Real-time risk monitoring allows for the rapid assessment of critical market variables and data points, enabling the timely identification of potential risks and the implementation of proactive measures by the community to prevent them. This approach ensures that the protocol’s growth is sustainable and well-managed, with potential risks identified and addressed proactively to ensure the long-term stability and health of the system. By constantly ingesting data and analyzing it in real-time, Chaos can identify potential risks, exposures, and the surfaces and protocol levers that could impact the system’s stability and performance, allowing for effective risk management strategies that remain ever-vigilant and adaptable.

Engagement scope

With this grant, Chaos Labs will customize its native risk monitoring and alerting platform for the Radiant protocol to ensure all activity is properly understood and risks can be proactively managed even in the most chaotic market conditions.

The risk management platform will include the following:

- Protocol & wallet monitoring

- Asset health and activities

- Alerting and notifications

- Market manipulation exposure

- User scenario modeling

Risk management platform

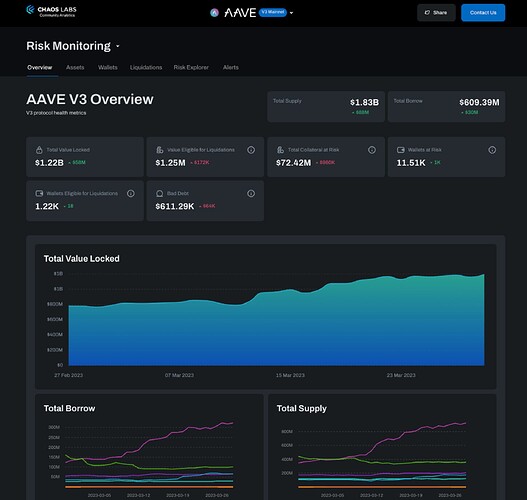

Through this partnership, the Radiant community will access a publicly open real-time platform to monitor and analyze protocol health. This platform will enable community members to drill down into specific scenarios in which the protocol could be negatively impacted, providing critical insights that can inform risk management and decision-making processes. With this comprehensive risk management solution, Radiant can remain proactive in mitigating risk and protecting user funds while optimizing protocol performance and driving long-term growth. This system is already live for existing customers such as Aave & Benqi.

Similar to them, the risk monitoring tooling will include several important features:

- Overview: This is the primary homepage for protocol risk management, providing users with a high-level overview of key risk metrics and health measurements aggregated from various sources. The dashboard includes critical data points such as value at risk, collateral at risk, total supply and borrows, and more, all of which are tailored to the specific needs of Radiant Capital. By presenting this data in an easily digestible format, users can quickly understand the ecosystem’s overall health, identifying potential risks or vulnerabilities requiring further attention. This gives users the tools they need to make informed decisions about their on-chain position, ensuring that they can optimize their portfolio performance while minimizing the potential for loss.

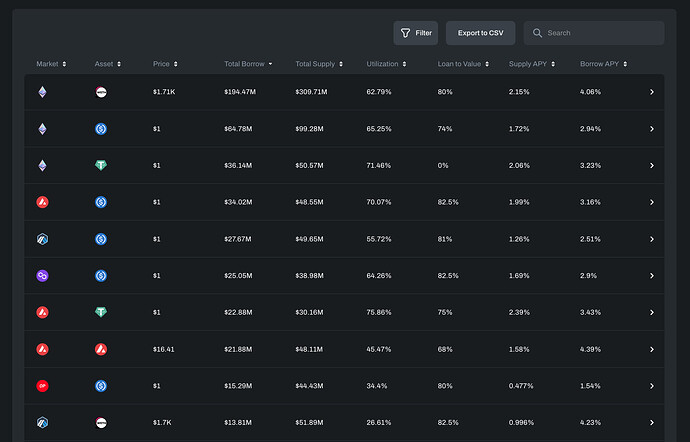

- Assets/Chains: Given that Radiant is designed as a cross-chain money market, we have implemented an “Assets” tab to provide users with a clear view of each asset’s health and relevant metrics across all supported chains. This feature enables users to access key data points, such as market capitalization, liquidity, and volatility, for each asset across all chains, facilitating more informed decision-making when managing their portfolio. By presenting this data in a user-friendly format, users can quickly assess the overall health of each asset and make informed decisions about their investment strategy. This enhances the overall user experience and promotes greater engagement with the Radiant ecosystem.

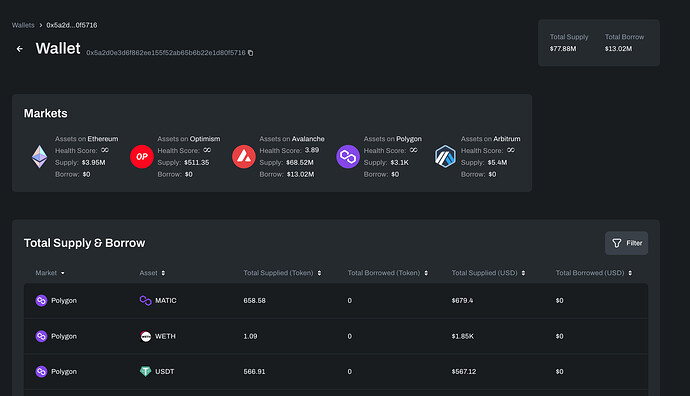

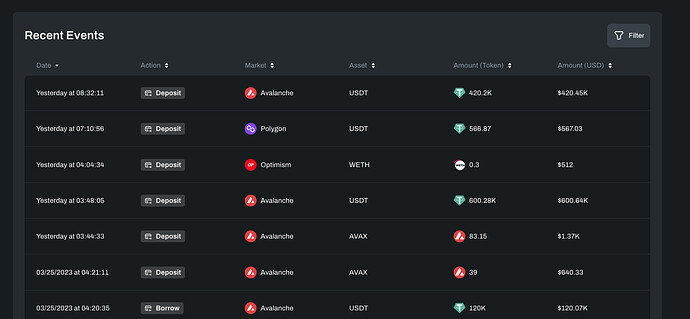

- Wallets: In addition to providing an overview of asset health and relevant metrics, the Radiant platform enables users to delve deeper into their positions or those of major protocol whales to better understand the potential impact of their actions or price movements on the ecosystem. This is made possible by including detailed information on each wallet’s current positions and a log of on-chain events when interacting with the protocol. By providing this level of transparency, users can gain a more comprehensive understanding of their position within the ecosystem and make informed decisions that align with their investment strategy.

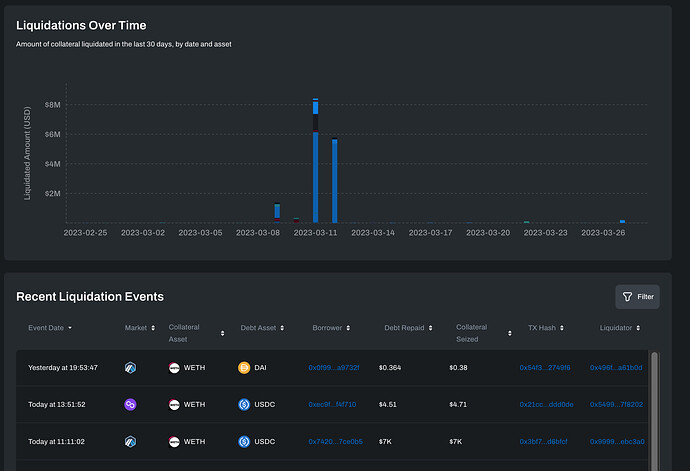

- Liquidations: Time series and data tables highlight protocol liquidation bots’ status and activity to showcase the health of these transactions and protection against bad debt. These data points include information on which assets were liquidated when the liquidation occurred and any relevant on-chain transactions associated with the event. By providing this level of transparency, users can better understand the overall health and stability of the ecosystem, identifying potential risks or vulnerabilities that require further attention.

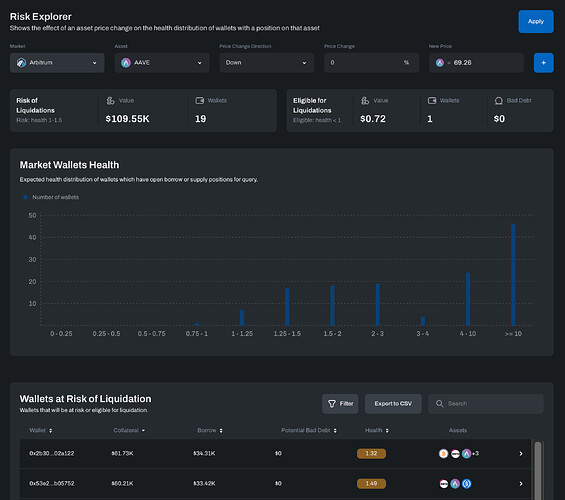

- Risk Explorer: A powerful simulation tool to provide users with a more comprehensive understanding of the potential impact of token price changes on protocol risk and liquidations. This tool enables users to simulate the effect of changes in the price of one or more tokens on the risk of the protocol and potential liquidations, highlighting the potential impact on the Radiant ecosystem across multiple chains. The simulation tool works by simulating the state of each chain separately according to the simulated scenario and then viewing the impact on the protocol as a whole across all deployments. This feature enables users to understand better the potential risks associated with different token price scenarios, facilitating more informed decision-making and risk management.

- Alerting: As mentioned above, this has already been built out and fully functional monitoring for whale positions, but it can be expanded quite robustly. It will allow the community to stay current on major changes to on-chain activities that may impact the health or risk of the protocol. These alerts are designed to consider various factors, including whale positions, asset cap usage, volatility, and more, enabling users to stay informed of potential risks or vulnerabilities. Providing timely and relevant information on potential risks and changes allows users to make informed decisions about their on-chain position, optimizing their portfolio performance while minimizing the potential for loss. These alerts are available within the platform and through other community-focused channels such as Telegram, Discord, and Slack, ensuring users stay informed and engaged with the ecosystem.

The flexibility and customization of the risk alert structure make it adaptable to the unique needs and risks of the Radiant protocol community. The community can set its thresholds and frequency of alerts based on its risk tolerance. New data points can be added and tracked as needed to ensure the ongoing accuracy and relevance of the alerts. This approach enables the community to maintain a proactive and dynamic risk management strategy, ensuring the long-term health and stability of the Radiant protocol.

We will integrate Radiant Capital’s on-chain data streams into our monitoring and alerting suite and support, with efforts to automate the protocol’s expansion where applicable over the initial 6-months after launch.

Funding

Total Cost: $50,000

- 50% ($25,000) paid upfront

- 50% ($25,000) paid upon platform delivery

Cost can be paid either in stablecoin or RDNT tokens.