Posting as a draft to request feedback on the proposal, guidance from the Radiant team on costs, and which Option to send to voting.

Abstract

Upon launch of Radiant v2, the looping function was not adequately informative. The text displayed on the site did not give a fair overview of the actions that the contract call would undertake. Given that several high value deposits were made while the UI was in this state, and that those who deposited via the 1-Click-Loop function account for a large part of Radiant v2’s TVL, it would benefit all parties to compensate those affected in a manner that keeps them aligned with the protocol, while also making amends for the unfairly displayed UI upon launch.

Motivation

Radiant v2 makes use of a mechanism whereby you must lock 5% of your deposited value as dLP (an 80/20 RDNT-ETH Balancer Pool Token) for a minimum of 1 month. This mechanism is in place to protect against mercenary capital, as only those with a significant positive stake in RDNT’s future price are able to farm RDNT emissions.

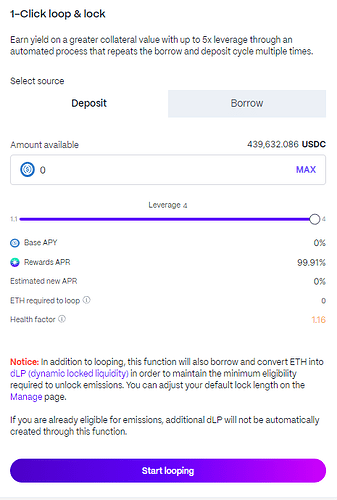

Radiant v2 has a 1-Click-Loop function, which, if used with the default 4x leverage setting, will take your deposit and loop it in Radiant. 5% of the new leveraged deposit (20% of your initial deposit!) is borrowed in ETH, single-sided deposited into the Balancer pool, and locked.

There are a number of issues with the 1-Click-Loop function, listed below:

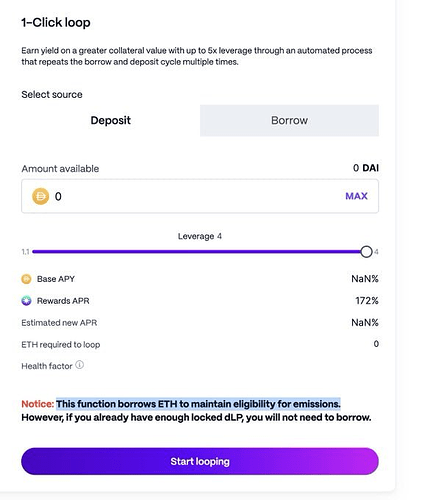

The top line of the UI suggests that it’s explaining what the 1-Click-Loop function does: ‘Earn yield on a greater collateral value with up to 5x leverage through an automated process that repeats the borrow and deposit cycle multiple times’. This is what looping means elsewhere, including on Radiant v1, and therefore taking this explanation at face value can be considered sensible.

There was no mention on the UI that the function would do anything more than borrow ETH to maintain eligibility for emissions. The wording being ‘This function borrows ETH to maintain eligibility for emissions. However, if you already have enough locked dLP, you will not need to borrow’. The implication here is that you can either borrow ETH (presumably to contribute more towards the protocol’s fees and reduce your ability to be mercenary capital), OR own a locked dLP.

There is no ability to set a slippage tolerance, which would have given some indication that a swap was occurring and allowed the user to double check what was happening. Regardless, this is extremely dangerous, and in my particular case it caused an immediate $200k+ loss via price impact with no ability to mitigate the loss. An unintended $1.1M+ locked market buy is bad enough, but into a $10MM 80/20 pool with a 20% price impact that was immediately arbitraged away is beyond painful when it’s due to a misleading and inadequate front-end.

It’s important to note that many of those who have been most affected by this are seasoned DeFi veterans (SifuVision, chud.eth, RiffRaff, to name a few), not just naive market participants. This lends further credence to the notion that the UI was misleading to the point of compensation being warranted.

Rationale

The rationale for this proposal is twofold:

Firstly, it is clear that the UI was not up to par in being adequately informative, as evidenced by the negative sentiment towards the issue seen across Twitter, Discord, and Telegram, as well as the fact that significant changes needed to be made afterwards to clarify what the function does. A mistake was made, and making things right where that’s the case is the way to build a good reputation within the space. Protocols that have solidified positions as stalwarts of the DeFi space have always done right by their mistakes when they have occurred, which has surely contributed to their staying power and continued success. The Radiant team has since provided further clarity with a required tick-box that explains the actions taken within the transaction as soon as they were made aware of the issue, so the number of people affected by the misleading UI was limited by their swift and prompt action on that front.

Secondly, many of those affected are currently providing a large portion of Radiant v2’s TVL, which contributes to the protocol’s fees, and maintains a flywheel effect. If these users continue to feel misled and without a fair solution, then they may be less inclined to keep their funds on Radiant, and naturally maintain negative sentiment towards the protocol. The goal of Radiant v2 is to attract and maintain sticky TVL; leaving this unaddressed would achieve the opposite effect.

Key Terms

Option 1:

All participants who used the 1-Click-Loop function prior to the UI adjustments made by the Radiant team will be compensated by legal rescission - the complete reversal of the transactions in question, such that participants are left in a position where their assets and liabilities are as if they never interacted with Radiant v2.

Option 2:

All participants who used the 1-Click-Loop function prior to the UI adjustments made by the Radiant team will be compensated in vested RDNT, in a way that matches up to the price impact they incurred as a result of the UI. Put simply, this would mean that a loop into a low liquidity Balancer pool would be compensated more RDNT than the same value loop into a more liquid Balancer pool, compensating users proportionately to the impact the UI had on their position.

Option 3:

Do nothing.

Specifications

A list of all 1-Click-Loop transactions prior to the UI adjustments (Radiant team matches the Github push timestamp to a given block number) is compiled.

The value of the ETH single side deposit into the Balancer pool for each loop is noted.

Option 1:

At the end of each affected user’s lock, offer OTC swaps of dLP in exchange for the corresponding amount of ETH taken by the loop function. These funds would come from the Radiant Treasury, and the Treasury would build POL by acquiring the dLP, which it could use to farm BAL via the upcoming Balancer gauge.

Option 2:

Using the block number of the loop, we can check the balance of ETH in the 80/20 Balancer pool just before the loop occurs, and therefore calculate the value of the unavoidable price impact.

This value, in RDNT tokens, is added to the 90-day vesting of each corresponding affected wallet address. The RDNT tokens would come from the DAO reserve, and can be replenished over the coming weeks with penalty fee RDNT as people make early exits.

For context, my estimated numbers show that this represents the equivalent of around 10 days of farming rewards for each address in the worst case. Quite an insignificant cost relative to the reputational value, and longevity of TVL.

Option 3:

Do nothing.

Market Parameters

RDNT price: $0.358 at time of posting.

Steps To Implement

As noted above in the Specifications

Timeline

Immediate as approved and implemented.

Overall Cost

TBC by the Radiant team following the above steps; I do not have the exact timestamp that the UI was changed, etc. However, rough maths indicates that it would be no more than $500k worth of RDNT for option 2.

Option 1 would depend heavily on the RDNT/ETH price at the time of execution.

I trust that given the parameters above, the Radiant team is able to assist by giving an indication of the definitive costs of undertaking each option.