Author: RociFi

Key terms

Credit scores: numerical scores representing a user’s (wallet address) creditworthiness and trustworthiness based upon their on-chain transaction history. The scale is 1 to 10 with 1 being the lowest risk (best score) and 10 being the highest risk (worst score). The scores are calculated looking at numerous DeFi protocols across 8 blockchains - not simply Radiant.

Abstract

RociFi is a DeFi protocol enabling under-collateralized lending via on-chain credit scores – issuing 35,000 credit scores and 1,300 under-collateralized loans to-date.

Our credit scores are real-time, composable, and scalable to allow any protocol in DeFi to integrate them seamlessly. Integration via loan pool parameter recommendations and risk dashboard could allow Radiant Capital to increase capital efficiency and risk management.

To-date, we have integrated our scores with CyberConnect, Relation Labs, and ConvoSpace; and received grants from Lens and Aave to explore the same.

Motivation:

Capital efficiency and risk management are at the core of all DeFi lending platforms. Simply put, if protocols have better information, they can make better decisions for their token holders, which can lead to greater revenue with less risk.

Our credit scores have been battle-tested under the difficult conditions of blockchain-native under-collateralized lending; generating an 82% repayment rate. Having access to battle-tested user level credit risk metrics could allow Radiant to become safer and more capital efficient, while building the foundation for differentiated products like user customized lending in the future.

Rationale

The integration of credit risk analytics into Radiant could drive greater revenue to the treasury and less risk to depositors. It further could allow Radiant Capital to differentiate itself in the future with new product offerings like customized lending, which fits with the ultimate vision of growing the utility of the Radiant Capital ecosystem. Furthermore, our credit scores have multi-chain coverage, meaning that they can grow with the Radiant ecosystem is it expands to other blockchains.

Radiant using RociFi credit scores for user level, risk-based loan parameter optimization, offers three key benefits (ranked by priority):

-

Increased Capital efficiency – more revenue to the treasury based upon loan-to-value ratio optimization in the lending pools. Near-term priority.

-

Risk monitoring on a user level granularity for pre-emptive spotting of red flag situations – proactively decrease loan-to-value ratios or other risk mitigating actions. Near-term priority.

-

Customized lending terms for every user based on credit scores – product differentiation and revenue boost. Mid-long term priority.

Capital Efficiency Simulation - Radiant Capital

We ran a complete capital efficiency and risk simulation for Radiant Capital using our credit scores over an evaluation period from 2022–08–05 to 2022–10–31.

We did an analysis where we defined “good” accounts as those that did not default on their loans due in this period, and “bad” accounts as those that did. To better understand if more creditworthy borrowers are less likely to get liquidated, we can look at the distribution “Actual Goods” vs. Actual Bads” for the broader ecosystem first.

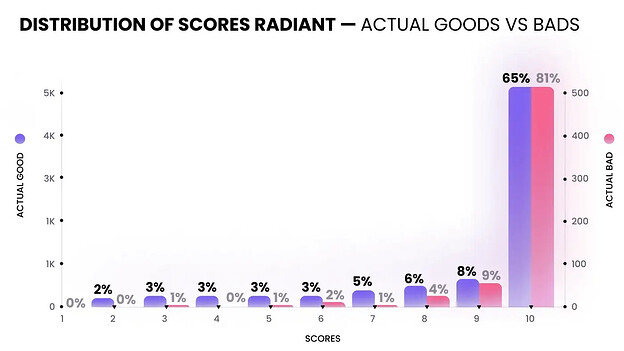

To get a better understanding of the impact specifically to Radiant we can take a look at the distribution of Radiant borrowers. Any borrowers who have only ever taken 1 loan are excluded from this analysis.

For Radiant, the distribution of borrowers tends to lean more to the right. Roughly 81% of “bad borrowers” get score 10 with 65% of borrowers who did not default also ending up on score 10. About 95% of “bad borrowers” end up on scores 7–10. Part of the reason for 65% of “good borrowers’’ ending up on score 10 has to do with both length and depth of credit history. 50% of these borrowers had fewer than 5 loans and all of them had accounts less than a week old at the time of scoring.

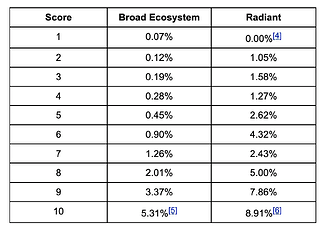

The bad loan rates for the broader ecosystem and Radiant are as follows:

On the broader ecosystem, the risk of liquidation remains well below 1% up to score 6, however for Radiant borrowers this risk is generally much higher, with the risk already at 1.05% on score 2. On both we can see that the risk is increasing with score, with the exception of some confusion around score 3 & 4, 6 & 7 on Radiant.

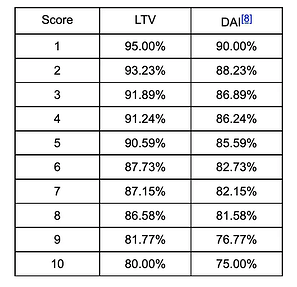

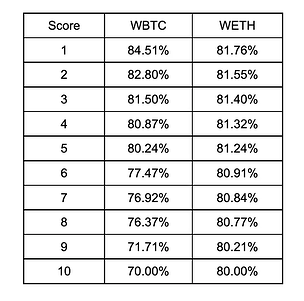

An LTV curve by score is proposed below based on an assumption around liquidations slippage, implied default rates, and asset standard deviations. For reference, RociFi’s credit score scale is 1-10 with 1 being the best and 10 being the worst. Furthermore, the LTVs are intentionally aggressive to generate the most aggressive liquidation scenarios, thus most conservative projections.

For stable collateral assets (USDC / USDT):

For volatile collateral assets:

The formula for picking the LTV curve here was as follows:

The idea here being assuming that we don’t want LTV’s to exceed 100%, using a 5% margin of error, we scale back the LTV by the Expected Default Rate, and 2x the daily standard deviation of price returns. The scaling factor was selected in each instance so that whenever volatile collateral is involved, in the worst case we assign an LTV of 60%, this is consistent with the current maximum LTV on Radiant. Given default risks and price volatility, we believe this LTV curve conservatively gives sufficient runway for fast price movements that may cause problems for liquidators in light of default risks.

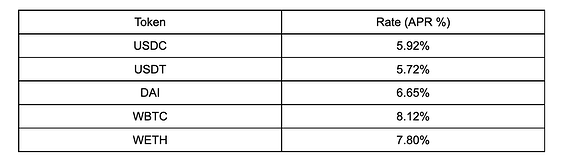

Following these LTV’s we simulate lending revenue’s using approximate interest rates based on what was observed on Radiant, those APRs used for simulation are as follows:

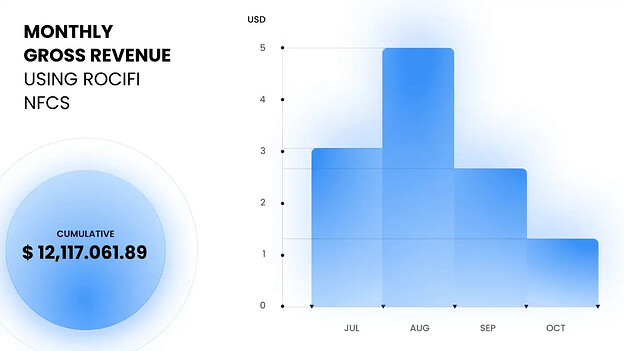

We estimate if Radiant had used RociFi’s LTVs as proposed, it could have generated $12,117,061.89 in revenue.

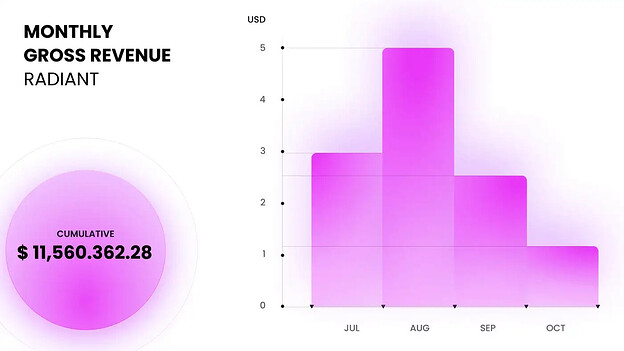

For comparison, we also look at the revenue we estimate Radiant would generate using current base LTV’s and the interest rates proposed in this document. Since July, we estimate this would have been $11,560,362.28, annualized.

Obviously, increasing the leverage borrowers are allowed to take enhances the potential return given the same interest rate. The increase in revenue is about 5.19% increase, which represents the effective increase in capital efficiency to the Radiant ecosystem.

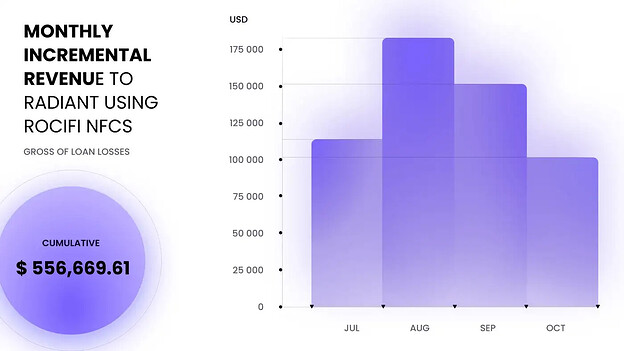

We can take the difference in these quantities, and look at the incremental revenue by month:

Overall, we estimate that using the RociFi NFCS, Radiant could have generated an additional $556,699.61 in revenue.

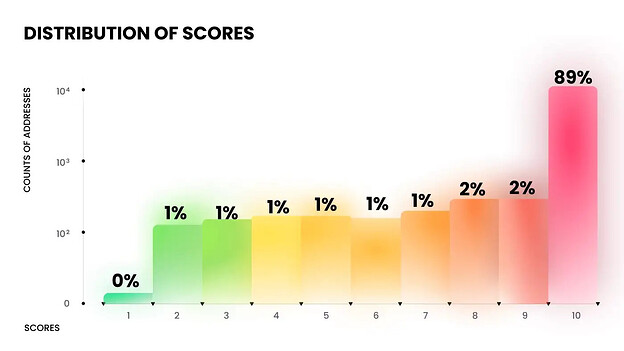

Loan Distributions – currently, we rank 89% of Radiant borrowers as 10. The risk observed among Radiant Borrowers is generally much higher than the broader ecosystem. Generally speaking the feature values observed for Radiant borrowers do indicate they are of higher risk than the average borrower that uses AAVE / Compound. This is not to say all Radiant borrowers are risky, but a sizable minority are. Regardless, the RociFi NFCS allows for credit migration based on user behavior, both good and bad. Those Radiant borrowers who use the protocol responsibly, along with other protocols, will see their scores will increase over time.

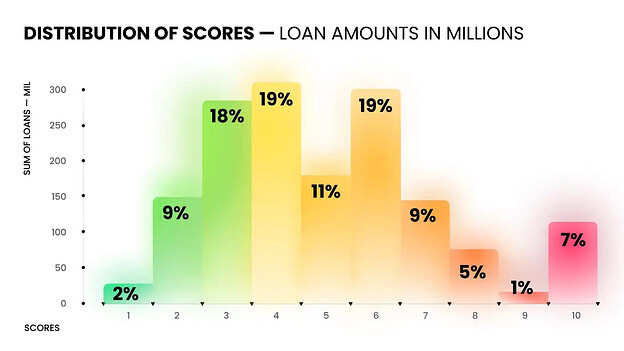

Although most Radiant borrowers score closer to a 10, the majority of borrowing volume comes from less risky better ranked borrowers. 47% of borrowing volume is coming from borrowers ranked a 4 or better.

Potential Losses – using the proposed LTV curve principal losses were minimal. We observed only 1 instance of principal loss estimated at $2,917.49, i.e. bad debt.

The full simulation report can be found here. Also, an additional example that we ran for Moonwell, lender on Moonbeam, as well.

Specifications

RociFi is requesting an initial 6-month pilot before both parties commit to a longer term engagement. The proposal covers the following deliverables:

- Credit Analytics – Dedicated instance and custom API made available for the protocol and stakeholders to query in near real-time. Includes credit scores and other key metrics for current borrowers. Example information below:

{‘CreditScore’: 2, ‘Address’: ‘0xdf0944d413f83abeba6bc23891bc183bb9d6a77b’, ‘features’: {‘count_borrow’: 103, ‘total_borrow’: 304940.38192349765, ‘total_repay’: 304550.954891286, ‘count_repay’: 95, ‘count_liquidation’: 0, ‘total_liquidation’: 0, ‘days_since_first_borrow’: 648, ‘count_deposit’: 238, ‘total_redeem’: 220858.1913208516}

-

Data integration – API data into a custom dashboard for real-time monitoring, plus continued maintenance.

-

Parameter Recommendations – Parameter recommendations based on simulations of expected liquidations across credit scores in Radiant lending pools; subject to price and liquidity volatility that may cause problems for liquidators.

-

Documentation of key terms and metrics.

These deliverables will be split into four main milestones and detailed in the following section.

Steps to Implement, Timeline, and Cost

Project team: Full-stack engineer, Project Manager, Data Engineer, and Data Scientist.

Monthly cost: $25,000 USDC per month with a 6-month term. All milestones must be approved by the protocol before moving onto the subsequent.

Milestones:

- Advance of first month’s payment of $25,000 USDC to cover setup costs (1-2 weeks)

- Setting up K8 cluster for the custom instance of the Underwriter API and its services

- Setting-up data lake in PostgresSQL

- Configure Airflow instance

- Configure data collectors (Airflow DAGs)

- Backfill data in the data lake

- Logging and alerting via Grafana and Prometeus

- Radiant Capital data integrated into data lake

- Credit Analytics, Setup and Testing (2-4 weeks)

- Training Credit Risk model on the data lake

- Configuring and customizing feature engine

- Testing new model version on the reference set

- Deploying new model to production cluster

- Data Integration, Setup and Testing (1-2 weeks)

- Production API deployed and tested

- Live dashboard tested and deployed for end user

- Documentation and Parameter Recommendation (1 week)

- Simulation environment of expected liquidations across current users (credit scores) in Radiant lending pools

- Stress test simulation against historical price and liquidity volatility of collateral used in lending pools

- Curate specific loan-to-value recommendations for each pool based on results

- Full documentation of key words and terms

Conclusion

We’d like to gauge interest before moving into a formal proposal.

Please post your thoughts in the comments section.

We are open to feedback or questions regarding the proposal. Thanks!