Abstract

Implement an independent, configurable Financial reporting software tool for the DAO Leadership, Community and Protocol. It can be used as a Financial Dashboard & Reporting tool and exported by Members to support Audit, Tax, Investment & Accounting processes.

KYAX proposes a 2 step program to minimize risk and mitigate spend:

- Phase 1: KYAX supports Abritrum to showcase and prove rationale. This means the

community has the option for a quick, easy configurable version of KYAX dashboards &

community driven reporting, with KYAX subsidizing the instance. - Phase 2: Full implementation, including all chains and wallets that Radiant.Capital interact with as of the approved date of this proposal.

Note - all data extracted by KYAX will be read-only. KYAX does not move, or transfer tokens

and will never have the ability to do so.

Motivation

There have been many financial incidents around PoLAR (Proof of Assets, Liabilities & Reserves - think FTX, 3AC), projects struggling to move into the next funding round and wasting valuable time manual reconciling & cleaning up financial, transactional data, on & off-chain. This has caused frustration across the industry, challenged investors and damaged protocols, projects and users.

To strengthen Radiant’s position as a leading, responsible, growth orientated DAO, the proposal for a SOC & ISO, auditable financial dashboard/reporting tool is required. See points below:

- Transparency and Trust: Providing easily accessible and insightful financial reports can enhance transparency and build trust with users.

- Improved Decision-Making: Having near real-time and comprehensive financial data readily available through KYAX can empower DAO members to make better-informed decisions about the protocol’s operations, resource allocation, and risk management.

- Community Service: Providing Audit, Tax & Accounting report exports for

Community members is a critical additional service, no matter what jurisdiction they engage with. - User Experience: KYAX’s user-friendly interface can make it easier for [non-native] users to understand the financial health of the protocol and track their own investments, potentially attracting new protocol members and investors.

- Regulatory Compliance: As regulations surrounding DeFi tighten globally, protocols will need to comply with stricter reporting requirements, which KYAX can standardize and automate.

- Attract Investors and Partners: Through using an ISO and SOC compliant tool, providing independent Financial Audits and Reporting, Radiant Capital can

demonstrate their organizational maturity & financial transparency.

Rationale

KYAX aligns with the core component of Radiant’s mission to keep the community safe. In the case of FTX & Celsius, having funds misallocated & lost, will cause irreversible damage to the community, the users, and brand.

KYAX helps protect against these risks through making the financial state of the DAO transparent and empowers Radiant Protocol & Radiant members to interact with the protocol with confidence. See points below:

Data Aggregation and Reconciliation:

- Cross-chain complexity: Radiant operates across multiple blockchains like

Ethereum, Avalanche, and Polygon. Manually tracking transactions across these

chains can be tedious and prone to errors. KYAX will reconcile & consolidate data

from various sources, providing a unified view of Radiant’s activity across all chains. This data is on-chain AND off-chain. - Streamlined Accounting: Radiant deals with diverse financial activities like deposits, borrows, interest accruals, and token rewards. KYAX can automatically categorize and reconcile these transactions, simplifying accounting processes and ensuring accuracy.

- Audit Preparation: Regulatory compliance is crucial for any DeFi protocol. KYAX can generate audit-ready reports, saving Radiant time and resources during audits. This will also provide Proof of Assets, Liabilities & Reserves for the public domain if appropriate.

- Investor Reporting: Radiant can leverage KYAX to generate detailed reports for investors, showcasing the protocol’s financial performance, asset allocation, and liquidity metrics. This fosters transparency and builds trust with stakeholders.

- Regulatory Compliance: KYAX can help Radiant comply with relevant regulations by creating reports conforming to specific reporting standards. This can mitigate regulatory risks and protect the protocol from potential legal issues.

- Risk Management: KYAX’s data analytics capabilities can help Radiant identify potential risks within their ecosystem, such as whale movements or unusual activity patterns. This proactive approach can help mitigate financial losses and maintain the stability of the protocol.

Additional Benefits:

- Customizable dashboards: KYAX allows creating custom dashboards tailored to specific needs. Radiant’s team can track key metrics like total value locked (TVL), utilization rates, and user trends.

- Improved Efficiency: KYAX automates various financial management tasks, freeing up Radiant’s team to focus on core development and community engagement.

Here are some specific scenarios where Radiant might use KYAX:

- Generating monthly investment reports for token holders.

- Preparing audits for regulatory compliance & investment opportunities.

- Monitoring TVL and liquidity ratios across different chains.

Key Terms

- KYAX - Know Your Assets & Transactions.

- Reconciliation - The activity of mapping and matching transactional data across multiple data sources to ensure that each transaction is correctly mapped, matched and connected, so that Wallet Balances, Account Balances, Bookkeeping, Financial Reporting and Accounting can be accurately and correctly completed, often at the end of a particular accounting periods.

- Financial Attestations - A Financial Attestation report is a report prepared and signed off by the reporting entity’s financial officer, attesting to the amount of funds and in-kind (where applicable) used on a project. This is required for all projects requiring transparency.

- PoLAR - Proof of Liabilities, Assets & Reserves

Specifications

- AWS: On-demand cloud computing platform.

- Single Sign On: auth.0

- KYAX Platform: A proprietary ICO & SOC compliant system that ingests crypto data, consolidates it and displays it.

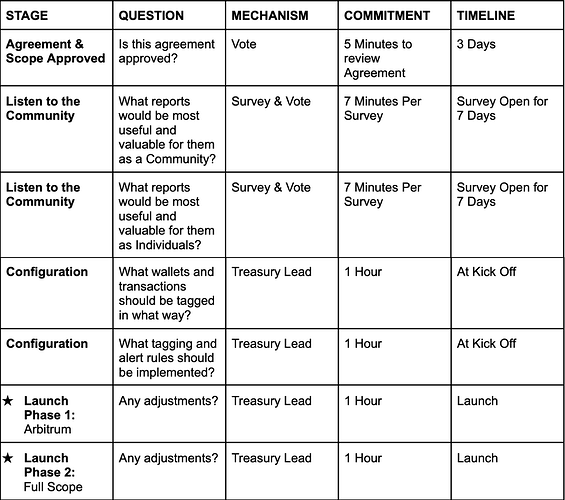

Steps to Implement

Timeline

Phase 1 & 2:

- Start Date: 1 day after proposal is approved

- Milestones:

– Community Feedback: Voting Finalized: 8 days after proposal is approved

– Configure Wallets & Transactions: 14 days after the proposal is approved (dependent on Treasury feedback).

– Go-Live Phase 1: 15 days after proposal is approved

– Go-Live Phase 2: Further adjustment dependent

Overall Cost

Phase 1 & 2:

- Phase 1(Arbitrum):

– $1,000 one time payment for Initial Onboarding.

– $500 recurring monthly payment - Phase 2(Full KYAX Launch)

– $3,000 one time payment for Full Scope.

– $1,000 recurring monthly payment (post Phase 1, this is the total monthly payment) - Costs can be paid with USDT, USDC, GBP or USD