Feedback 105: Establishing the Radiant Guardian Fund

Abstract

RFP Idea-XX (TBD) advocates for the creation of a new security framework known as the Radiant Guardian, consisting of three components:

-

Guardian Fund: A 4/7 multi-sig cold wallet holding diversified protocol assets.

-

Guardian Staking Contract: Enables users to stake their dLP to become eligible for protection.

-

Guardian LP Token (gLP): Enables users to secure the protocol by providing collateral into the Guardian Fund and also makes funds held in the Guardian Fund capital efficient, as it enables its use in DeFi.

In a DeFi landscape where 63% of all crypto hacks target lending and cross-chain protocols (Chainalysis, 2023), Radiant must transcend traditional security models. Radiant Guardian offers an electable economic shield that enhances trust, incentivizes long-term participation, and uniquely positions Radiant among a crowded field of DeFi protocols competing for institutional and whale capital.

Motivation

Web3 and DeFi protocols have proven highly vulnerable. In 2024 alone, decentralized finance suffered over $2.1 billion in losses due to smart contract exploits, oracle manipulations, custodian failures, and protocol mismanagement (Immunefi Crypto Losses Report, 2024).

Specific to lending markets, research shows:

-

Lending protocols account for ~35% of all DeFi hack losses (Chainalysis 2023 Crypto Crime Report).

-

Oracle failures were involved in 48% of price manipulation exploits.

-

Recovery rates after major hacks remain below 10% industry-wide (Rekt Database, 2024).

Radiant has already experienced the devastating impact of these risks with two major security incidents in 2024, leading to cumulative losses of over $54.5 million.

While Radiant DAO has aggressively upgraded its Security Operations (SecOps), governance audits, and incident response protocols, technological security alone is not enough to fully rebuild retail user, whale, and institutional confidence.

Institutions demand layered risk management strategies, not just code audits (Galaxy Digital Research, 2024).

Therefore, RFP-XX introduces an economically driven security guarantee, enabling Radiant to:

-

Restore trust post-breach.

-

Attract deeper-pocketed participants (whales, funds, institutions).

-

Offer differentiated protections that most competitors lack.

-

Build a more resilient, antifragile DeFi ecosystem.

Rationale

-

Enhanced Security Measures

a. Impeccable SecOps reduce but do not eliminate risk.

b. The Radiant Guardian Fund introduces an economic backstop, offering remediation when smart contracts, oracles, or custodians fail.

-

Restoring User Confidence

a. Following catastrophic DeFi failures like Euler, Mango Markets, and Yearn exploits, institutional DeFi adoption plateaued (Messari DeFi Risk Report, 2024).

b. Adding an economic protection layer dramatically increases Radiant’s appeal to capital allocators managing billions under management.

-

Incentivized Protection Model – The proposed solution introduces a new incentive to stake dLP, aligning their interests with the protocol’s stakeholders and growth.

-

Catering to Risk-Averse Users.

a. A Morningstar study (2024) on DeFi adoption noted that 58% of non-users cited “lack of protection” as their primary reason for abstaining.

b. By providing opt-in protection, Radiant can expand its audience beyond degens to risk-mitigated capital.

-

Long-Term Protocol Sustainability.

Rather than emergency measures during crises (which historically recover pennies on the dollar), the Guardian Fund establishes a pre-funded, transparent safety net.

-

Competitive Advantage

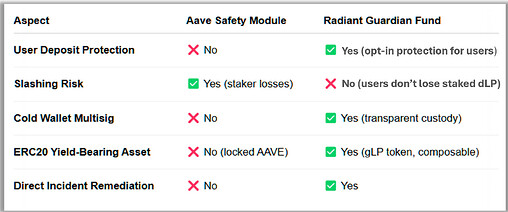

a. No Tier-1 DeFi lending protocol today offers this layered model (security operations + economic backstop + DeFi-native capital efficiency). Aave has implemented a feature along this line known as the Safety Module which protects the protocol itself (solvency), and user deposits but only up to a maximum of 2.5% losses of total TVL, see table to compare and contrast.

b. Radiant Guardian will make Radiant a first mover in a new DeFi security paradigm.

-

Mitigating Systemic Risks.

a. Large DeFi exploits often trigger industry-wide liquidity shocks (e.g., Curve exploit fallout, 2023).

b. Guardian Fund protection could contain Radiant-specific incidents before they metastasize into larger systemic events.

Implementation Details

The Radiant Guardian Fund will be implemented in two phases.

Phase I - Radiant Guardian Fund & Staking

The Radiant Guardian multi-signature wallet has already been established through RFP-51 as part of the broader economic reorganization. Now, the DAO seeks permission to develop the Guardian feature itself.

-

Users can stake dLP flexibly (liquid staking, no lockup).

-

To maintain eligibility for Guardian remediation, users must stake dLP valued at ≥10% of their net Radiant deposits.

Users who stake their dLP into the Guardian Staking Contract will become eligible for swift automatic remediation for the following covered events:

-

Smart contract exploits and hacks

-

Severe oracle failures or manipulations

-

Custodian risks and failures

-

Major liquidation failures

-

Bad debt

To qualify for protection using the Guardian Fund, the percentage of your staked dLP must be at least 10% of your net deposits within the Radiant markets.

Payout Mechanism

Should any of the above events happen, you will be entitled to a % of the total funds held in the Radiant Guardian Fund, up to a maximum of 100% of your net deposits.

In the event of a qualifying security incident, the Guardian Fund will be utilized to remediate eligible users who staked in the Guardian Staking Contract. The payout process will follow these key principles:

-

Eligibility Verification – Users must have maintained a staked dLP amount equal to or greater than 10% of their net deposits within Radiant markets at the exact block of the incident.

-

Proportional Compensation – Payouts will be distributed proportionally based on the user’s net deposits and the available funds in the Radiant Guardian Fund.

-

Multi-Sig Governance – A decentralized multi-signature wallet, the Radiant Guardian Multi-sig managed by the DAO, will oversee fund disbursement to ensure transparency and prevent misuse.

-

Timely Distribution – Once a security breach is verified, the DAO will initiate a structured payout process, prioritizing swift and efficient remediation.

Payout Mathematics

The Guardian Fund payout mechanism is designed to remediate eligible users following a qualifying incident. The payout amount (C) is calculated based on four key variables:

Variables:

-

N= User’s Net Deposits in Radiant markets (in USD equivalent) -

S= User’s Staked dLP at the incident block (in USD equivalent) -

G= Total funds available in the Radiant Guardian Fund at the time of payout (in USD equivalent) -

U= Sum of all eligible users’ net deposits (only those who meet the 10% staking requirement) -

C= User’s Remediation (payout amount)

Eligibility Condition:

S / N >= 0.10 (10%)

Payout Formula:

C = MIN ( (N / U) * G , N )

Explanation:

-

Users who meet the 10% stake requirement are eligible for remediation.

-

Each eligible user receives a share of the Guardian Fund based on the ratio of their net deposits (N) to the total eligible net deposits (U).

-

The payout is capped at 100% of the user’s net deposits (no user can receive more than they deposited).

-

If the Guardian Fund is insufficient to fully cover all eligible users, funds will be distributed proportionally.

Notes:

-

The Guardian Multi-Sig will execute the distribution following this calculation.

-

Only eligible users (those who staked ≥10% of their net deposits as dLP) will be included in

U. -

This formula will be applied to all eligible users simultaneously at the time of payout.

Initial Funding

The Radiant DAO will provide an initial capitalization of 50 million RDNT to the Guardian Fund. This funding will be deposited in two separate rounds during the year 2025: the first round will allocate 25 million RDNT, followed by a second round of 25 million RDNT later during the year.

The corresponding gLP tokens will be minted during the Phase 2 deployment. These tokens will be retained by the DAO and utilized either as collateral within the protocol or to support swap liquidity, depending on the strategic needs of the ecosystem.

Asset Composition

The Radiant Guardian Fund will hold a diversified portfolio of assets in the multi-sig, including BTC, ETH, USDC, USDT, RDNT, and their staked derivatives utilized in the Radiant Core markets. The asset allocation is flexible and can be unbalanced for extended periods of time, but there will be soft enforcement of ratios between the different assets.

-

Bitcoin, and its derivatives: 20%

-

Ethereum, and its derivatives: 20%

-

Stablecoins, and their derivatives: 20%

-

RDNT: 40%

Phase II - Radiant Guardian LP Token (gLP)

To enhance the capital efficiency of the Guardian Fund while enabling seamless user participation, the Radiant DAO will introduce the Radiant Guardian LP Token (gLP), an ERC20 token analogous to Liquidity Pool (LP) tokens, but instead of providing liquidity for swapping in a Decentralized Exchange, gLP will represent liquidity in the Guardian Fund MultiSig that is securing those who stake dLP to participate in the Radiant Guardian feature.

Users will be able to mint and redeem gLP through a straightforward deposit mechanism into the Radiant Guardian Fund. This process will utilize a mint/redeem system where only a small fraction of the assets are held directly by the contract (hot wallet), while the majority of funds will reside securely within the Guardian Fund multisig, functioning as an offline, cold-storage solution (cold wallet).

gLP holders will benefit from three primary incentives:

-

Sustainable Yield — 10% of protocol-generated revenue will be directed into the Radiant Guardian Fund without triggering additional gLP minting. This mechanism provides gLP holders with real, non-dilutive yield directly embedded into the token’s value.

-

DeFi Compatible — gLP will be ERC-20 compliant, therefore it can be integrated and used in the wider DeFi ecosystem, such as lending, borrowing, and staking.

-

Collateral Integration — gLP will be integrated into the Arbitrum RIZ Markets, allowing users to utilize it as collateral or earn additional yield.

-

RDNT Emissions — The Radiant DAO will further incentivize gLP adoption by allocating RDNT emissions to users who supply gLP into its corresponding RIZ Markets.

In addition to the above, users gain access to an instrument with many benefits over its traditional counterparts:

-

Diversified Crypto Instrument

-

Natively Yield Bearing

-

Pausable on-chain

-

Collateralizable

-

ERC20 Compliant

Cost Estimates

-

10% of Protocol Revenue

-

Feature development and testing

-

Ongoing support

-

Marketing the new feature

Voting

-

In Favor: Support the implementation of the Radiant Guardian Fund as proposed.

-

Against: Reject RFP-XX as proposed.

-

Abstained: Undecided, but contributing to quorum.