RFP-XX Idea: The New Radiant Economic Paradigm

Abstract

The Radiant DAO seeks to restructure key economic elements to build a sustainable, secure, and growth-oriented protocol that aligns stakeholder incentives and market dynamics. This RFP focuses on enhancing competitiveness and significantly reducing RDNT token inflation by using Dynamic Reserve Factors, changing the Revenue Distribution, creating a robust Emission Model to reduce waste in emissions allocation, establishing the Radiant Guardian Fund, discontinuing the qRDNT/qDLP Stream, and by diversifying the DAO treasury.

Motivation and Rationale

On October 16, 2025, Radiant experienced a sophisticated security breach, leading to the loss of over $50 million in core market deposits across the Arbitrum and BNB chains. The incident effectively reset the protocol on those chains, presenting an opportunity to implement much-needed economic reforms to ensure long-term sustainability and competitiveness.

-

Issue 1: Once emissions decline, users have little incentive to keep their deposits, as competitors offer lower Reserve Factors. While RDNT emissions effectively attract users to the protocol, they primarily lead to short-term leveraged looping rather than long-term retention. However, implementing a well-calibrated Emissions policy, along with a competitive and dynamic Reserve Factor structure, can give users a compelling reason to stay.

-

Issue 2: dLP lockers are essential for providing swap liquidity but have been overcompensated due to the reliance on unsustainable, inflationary mechanisms, such as subsidies for lockers due to high Reserve Factors and the anti-dilution stream. Since dLP lockers are otherwise unproductive, their rewards have been increased through artificial means.

-

Issue 3: The trust Radiant has built over the past two years has been compromised. To restore confidence, the DAO must initiate the remediation process while offering new depositors a way to hedge against the typical risks of a DeFi lending protocol. Additionally, the DAO’s holdings are heavily concentrated in RDNT, which could create solvency risks if they remain dependent only on the price of a single asset.

Addressing these key issues will significantly reduce inflation, making the protocol more sustainable, competitive, safe, and growth-oriented.

Key Terms

Reserve Factor: The reserve factor is a percentage of the interest paid by borrowers that is set aside by the protocol instead of being paid out to lenders.

qRDNT/qLP: RDNT or dLP that qualifies for the RFP-33 anti-dilution stream.

Subsidies: Subsidies are financial incentives by Radiant to encourage specific economic activities. They help promote growth, innovation, or stability in targeted markets. Radiant is distributing subsidies through its emissions, which users see on the UI below the default APY on each market.

Emissions Reserve Wallet: The wallet holding RDNT earmarked for subsidies which are unlocked linearly with 2 years remaining through streaming.

Implementation Details

Part 1: Fee Distribution, Emissions

Adjustment 1: Dynamic Reserve Factors

Since its inception, Radiant has implemented significantly higher Reserve Factor values (75%) across all assets compared to competitors. The unique economic model fueled Radiant’s hyper-growth by allocating 60% of all fees to dLP holders, encouraging deep liquidity for the RDNT token while providing substantial subsidies for both lenders and borrowers. As a result, it attracted users from the broader lending-borrowing ecosystem quickly.

The shortfall for these subsidies was covered by emissions from the DAO’s emission reserve wallet through RDNT interest rate rewards. However, this approach has led to inflation and an unsustainable system. The DAO had already been planning a gradual recalibration of the economic model to ensure sustainability, but the regrettable 2024-October hack afforded the DAO with a unique opportunity to implement these changes all at once. To address this, the Radiant DAO plans to use a dynamic Reserve Factor system to be competitive within the crypto lending ecosystem, allowing a greater portion of fees to flow directly from borrowers to lenders.

The new dynamic reserve factors shall be market-oriented and will be set based on competitor analysis to ensure Radiant remains more competitive than other protocols. Additionally, dLP holders will continue to receive 60% of protocol fees, preserving the deep liquidity that the RDNT token already benefits from.

Expected Outcome: Despite the reduction of the Reserve Factor for some assets, emissions will remain for quite some time. As the reserve factor becomes more competitive, TVL is expected to grow, which should maintain or even increase overall protocol fees.

Addendum 1: Reserve Factor Example Changes

Adjustment 2: Dynamic Revenue Distribution

The distribution of protocol fees is determined by the Reserve Factor. A portion of the fees goes to Lenders, while the rest contributes to Protocol Revenue. Previous RFPs have misused terminology related to fees and revenue. Going forward, the DAO will define these terms exclusively as established ecosystem-wide:

- Borrower Interest (APY) = % charged to borrowers.

- Protocol Fees = Borrower Interest (APY) + Liquidation Fees.

- Protocol Revenue = Protocol Fees - Lender Interest

- Reserve Factor: Reserved % of total protocol fees retained by the protocol, after paying lender APY, for various purposes such as remediation, emissions, Guardian Fund, and OpEx…, and in the case of Radiant Capital, it is also used for dLP lockers APR.

The Fee Distribution model approved in RFP-7 allocates fees in absolute terms, preventing the adoption of a dynamic Reserve Factor. This structure only aligns with RFP-7 as long as the Reserve Factor remains fixed at 75%.

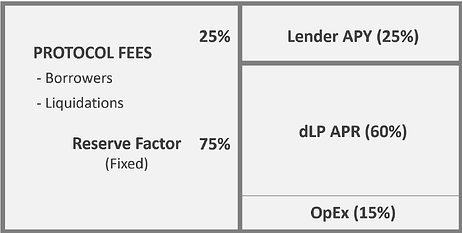

Current (RFP-7) Fee Distribution (Absolute/Fixed Reserve Factor):

-

60% of protocol fees are streamed to Dynamic Liquidity (dLP) lockers

-

25% allocated as the base APY to lenders

-

15% streamed to a DAO OpEx wallet

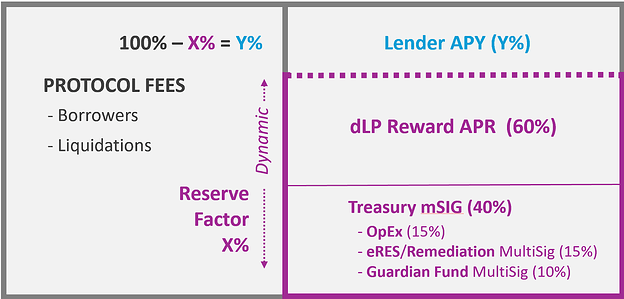

New (RFP-XX) Dynamic Fee Distribution (Dynamic Reserve Factor):

The Dynamic Reserve Factor will ensure that all fees are calculated as a percentage of the total collected fees, following the formulas:

Lenders’ Base APY → 100% - Reserve Factor %

Protocol Revenue → Borrowers’ FEE% * Reserve Factor%

-

60% of protocol revenue is streamed to Dynamic Liquidity (dLP) lockers

-

15% streamed to Emissions Reserve/Remediation MultiSig

-

15% streamed to a DAO OpEx wallet

-

10% streamed to Guardian Fund wallet

Example with $100 Protocol fee and 20% RF

Protocol Fees ($100)

-

Depositor APY% (20% Reserve Factor): $80 (This is done via Code automatically.)

-

Protocol Revenue: $20 (This is done via Code automatically.)

-

dLP Rewards: $12 (This is done via Code automatically.)

-

Treasury Multisig: $8 (This is done via Code automatically.)

-

DAO OpEx: $3 (Manual transfer from Treasury MultiSig to DAO OpEx MultiSig)

-

Emissions Reserve/Remediation MultiSig: $3 (Manual transfer from Treasury MultiSig to Emissions Reserve MultiSig OR Remediation MultiSig)

-

Guardian MultiSig: $2 (Manual transfer from Treasury MultiSig to Guardian MultiSig)

-

-

Addendum 2: Fee Distribution Math

Expected Outcome: Shifting the fee structure from absolute to relative will enable the implementation of Dynamic Reserve Factors. By consistently replenishing the Emissions Reserve through revenue, emissions rewards can be sustained without requiring additional inflation or token minting.

Adjustment 3: Weighted Emissions Allocation Model

Historically, Radiant followed an asset-agnostic approach to emissions, distributing RDNT subsidies equally across all markets. Moving forward, the Radiant DAO will implement a weighted allocation model to distribute subsidies more strategically. This approach will consider multiple factors to optimize incentives and gradually reduce reliance on emissions.

Key Adjustments:

-

Higher subsidies for new markets to encourage adoption and liquidity.

-

Increased support for low-TVL markets relative to total on-chain TVL.

-

Aligning with partner incentives to maximize ecosystem collaboration.

-

Emissions-free markets to promote organic, self-sustaining liquidity.

-

Gradual phase-out of asset-agnostic subsidies over the next two years.

The ultimate goal is for the Emissions Reserve to accumulate more RDNT than it distributes, creating a net deflationary effect and ensuring long-term sustainability.

Expected Outcome: By optimizing the Emission Model, fewer RDNT tokens will be wasted on subsidies that do not drive meaningful growth for Radiant. Identifying the most impactful emission strategies will allow the DAO to maximize ecosystem expansion while minimizing unnecessary emissions and subsidies.

Part 2: Guardian Fund, qRDNT, and Diversifying Treasury Assets

Adjustment 4: Radiant Guardian Multisig Wallet

The Radiant DAO seeks to establish a novel, electable security framework designed to protect against losses unrelated to market events called the Radiant Guardian Fund. The initial phase involves setting up a Multisig wallet to securely hold these funds and slowly accumulate capital while developing the feature itself. The specific mechanics and locking requirements will be detailed in a forthcoming RFP.

When you deposit crypto assets into any protocol, your funds are exposed to various risks associated with that protocol. The Radiant Guardian Fund is an electable feature designed to safeguard your funds from these risks. In order to unlock the feature you will have to stake dLP as a percentage proportional to your net deposits in the Radiant Core and RIZ lending markets, similar to how dLP rewards work. You will remain eligible for protection as long as you maintain the required percentage of staked dLP.

Covered Risks

If you deposit crypto assets into any of Radiant’s lending markets and stake the required dLP, the Radiant Guardian Fund offers protection against:

-

Smart contract exploits and hacks

-

Severe oracle failures or manipulations

-

Custodian risks and failures

-

Major liquidation failures

-

Bad debt

For now, the DAO seeks permission to set up the Radiant Guardian Multisig wallet and start accumulating funds.

Expected Outcome: The trust Radiant built up over the last two years was damaged. The Radiant Guardian Fund is the first step to rebuilding that trust by creating a safe way for depositing funds into Radiant without any of the protocol risks associated with DeFi lending markets.

Adjustment 5: Repurposing qRDNT/qDLP Stream

RFP-33 implemented an anti-dilution stream for dLP holders to offset its substantial inflationary impact. However, the Radiant DAO believes these effects have already been priced in, and the stream now primarily adds to inflation without delivering significant benefits to the DAO or dLP holders. Additionally, the effort to remediate losses while restoring faith and RDNT market value should bring more impact to qRDNT/qDLP holders than simply seeing this promise through as originally imagined under different circumstances.

Going forward, this stream will be redirected to the DAO wallet for multiple purposes, with a strict commitment to not selling any RDNT.

New Stream Purposes:

-

Remediation Effort

-

Guardian Fund Capitalization

-

Liquidity in RDNT/USDC RIZ Market

-

DAO Asset Diversification

Expected Outcome: Reducing inflation should lead to a higher net real APY for dLP holders by maintaining the value of the assets in the dLP lock.

Addendum 3: qLP/qRDNT Stream Remaining Lifecycle

Adjustment 6: Adding Stability and Yields to Treasury

A diversified DAO treasury is crucial for long-term sustainability, risk management, and strategic growth. By holding stablecoins, Bitcoin, Ethereum, and other cryptocurrencies, the treasury can balance stability with exposure to potential upside. Other crypto assets, including governance tokens and yield-generating assets, enable a constant stream of income from other sources and governance decisions in other DAO-s.

Radiant DAO will implement a market-neutral strategy to diversify its treasury while maintaining price stability for its native token:

-

Over-the-Counter (OTC) Trades – Radiant DAO will engage with private buyers and institutional investors via OTC desks to execute large trades discreetly, avoiding market disruptions.

-

Private Token Swaps – The DAO will collaborate with other projects and DAOs for direct token swaps, enabling treasury diversification without impacting market liquidity.

-

Loans Through RDNT RIZ – Radiant DAO will use RDNT in RIZ to borrow USDC, preserving treasury value without exerting sell pressure.

-

TWAP (Time-Weighted Average Price) Execution – To further mitigate market impact, Radiant DAO will utilize TWAP strategies to gradually sell small amounts of RDNT over time, and only above a price of $0.2/RDNT/30 Day Rolling Simple Average.

Diversification mitigates the impact of single-asset declining in value while maintaining exposure to the broader crypto economy. Ultimately, a well-balanced treasury enhances a DAO’s resilience, enabling it to fund development, incentivize contributors, and adapt to changing market conditions.

Projected Effects

-

dLP Lockers will continue earning 60% of protocol fees in assets like USDC, WBTC, and ETH.

-

With this RFP’s approval, RDNT inflation should be significantly reduced, targeting zero within 1-2 years.

-

Both Core and RIZ markets will become more competitive even without emissions, making zero-emission assets viable.

-

Restore confidence by establishing the Radiant Guardian Fund.

-

Additionally, the DAO will secure essential funds for the remediation effort without selling any RDNT on the open market, or in market neutral transactions.

-

Diversified DAO Treasury assets will allow for long-term operations and stability while generating yield.

Steps to Implement

-

Gradually reevaluate and reduce the Reserve Factors over time.

-

Change the Fee Distribution to allocate fees to the Emissions Reserve, Remediation, and the Guardian Fund.

-

Develop a new Weighted Emissions Allocation Model.

-

Create the Radiant Guardian Fund multisig wallet.

-

Redirect the qRDNT/qDLP stream to its new purposes.

-

Diversify DAO Treasury long-term.

Cost Analysis

- No direct costs to the DAO.

Voting

In Favor: This proposal represents a major step forward in economic sustainability, competitiveness, and growth. By voting in favor you agree to ALL prerequisites, steps and implementations in this proposal.

Against: Rejecting RFP-XX as proposed.

Abstained: Undecided, but contributing to quorum.